Before you do anything, you must know where you are financially. Not assume…know. When your income comes in, where does it go? Who are you making rich? To get an accurate picture of your money’s journey, you must do what is called Tracking. No, not budgeting. With budgeting, people make assumptions…”Oh I think I will spend this amount on groceries this month or this week”. But with Tracking, you see exactly how much you spend on groceries each week/month.

How Do You Track?

In a nutshell, Tracking is making note of every cent that you spend, when you spent it and on what it was spent.

1) So, for the next month, every time you make a purchase, I want you to:

- Write down in a small notebook OR note in your phone, every time you make a purchase (whether cash or credit).

- Note how much you spent

- Note what you bought & where you bought it from

- Note which day you bought it

2) Every day for this month, check and make sure that you have noted every purchase thus far.

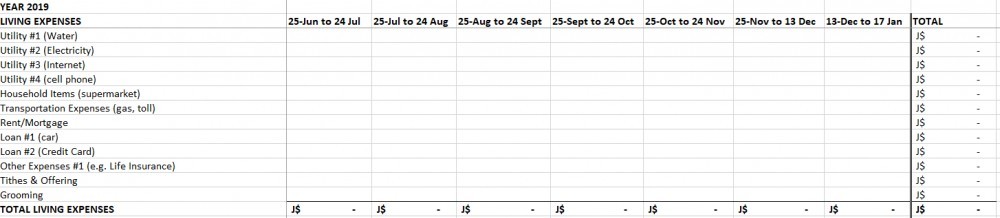

3) Use an excel sheet, like the example below, to enter your data weekly, so that you can have a full picture of what occurred for the month.

Why Track Your Money?

By accounting for every cent you spend and inputting it into the above mentioned excel sheet, you can clearly see where your money is constantly going. You can then make decisions on which areas you can cut back your spending. One of the first steps you can take to change your finances is to eliminate all unnecessary spending.

You can also see how your income compares to your expenses. Are you making enough money to cover your monthly expenses or do you constantly have to live off credit cards or borrow from friends & family? If you are spending more than you make, that’s a red flag. You have two choices…cut back your expenses so that it falls within your income OR find ways of earning more cash. Is it time for you to find a better job? Is it time for you to find other streams of income besides your job?

Bottom line…you must know how bad your financial situation is, so that you can accurately come up with a plan that will take you out of poverty.

What Next?

Now, that you know where you are financially, it’s time you get financially educated, so that you can chart the best route for your financial freedom.

See you next week for Part 2 of this series, where we continue to look at the initial steps that can be taken to change our financial situation.

Tracking my money and budgeting has always been a sore point for me as I am guilty of plain out spend, spend spend…only to later question where has all my hard earned money gone.

I am really glad I found your advice to track it. This is a new concept to me all together and makes so much more sense than trying to budget…honestly, that has never really worked.

I want to buy a house and realize sacrifices need to be made and now I have a focus to be more diligent. I think tracking my cash is going to really help me make more affirmative decisions.

Thanks A Bunch!

Ropata

Hi Ropata,

I am so happy you found this information useful. I wish you all the best on your financial goals.

Take Care!

To most people, this seems like extra work or responsibility so they don’t pay much attention to tracking their expenses. I know because that’s what I feel the first time someone told me that I should track my own. It’s like “I’d rather focus on making more money than track my expenses”. But like you said, if we need to move forward and make progress, we need to do it. This article has reminded me once again of this very important matter. Thank you.

Hi Gomer,

I am happy this article served as a timely reminder for you. All the best in your endeavours. May you continue to make progress and be prosperous.

Take care!